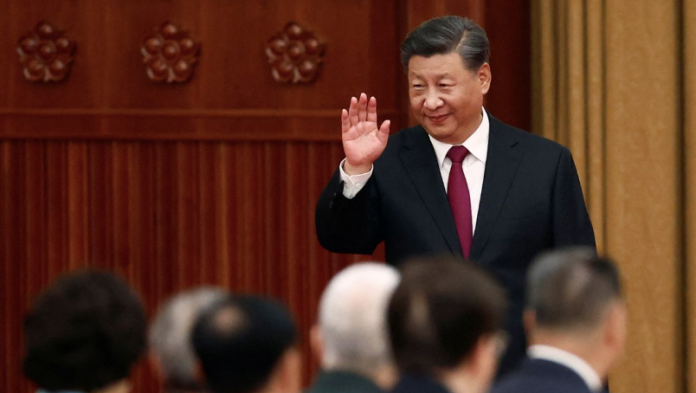

When Xi Jinping came to power a decade ago, China had just overtaken Japan to become the world’s second largest economy.

It has grown at a phenomenal pace since then. With an average annual growth rate of 6.7% since 2012, China has seen one of the fastest sustained expansions for a major economy in history. In 2021, its GDP hit nearly $18 trillion, constituting 18.4% of the global economy, according to the World Bank.

China’s rapid technological advances have also made it a strategic threat to the United States and its allies. It’s steadily pushing American rivals out of long-held leadership positions in sectors ranging from 5G technology to artificial intelligence.

Until recently, some economists were predicting that China would become the world’s biggest economy by 2030, unseating the United States. Now, the situation looks much less promising.

As Xi prepares for his second decade in power, he faces mounting economic challenges, including an unhappy middle-class. If he is not able to bring the economy back on track, China faces slowing innovation and productivity, along with rising social discontent.

“For 30 years, China was on a path that gave people great hope,” said Doug Guthrie, the director of China Initiatives at Arizona State University’s Thunderbird School of Global Management, adding that the country is “in deep trouble right now.”

Economic slowdown and rare dissent

While Xi is one of the most powerful leaders China and its ruling Communist Party have seen, some experts say that he can’t claim credit for the country’s astonishing progress.

“Xi’s leadership is not causal for China’s economic rise,” said Sonja Opper, a professor at Bocconi University in Italy who studies China’s economy. “Xi was able to capitalize on an ongoing entrepreneurial movement and rapid development of a private [sector] economy prior leaders had unleashed,” she added.

Rather, in recent years, Xi’s policies have caused some massive headaches in China.

A sweeping crackdown by Beijing on the country’s private sector, that began in late 2020, and its unwavering commitment to a zero-Covid policy, have hit the economy and job market hard.

“If anything, Xi’s leadership may have dampened some of the country’s growth dynamic,” Opper said.

More than $1 trillion has been wiped off the market value of Alibaba and Tencent — the crown jewels of China’s tech industry — over the last two years. Sales growth in the sector has slowed, and tens of thousands of employees have been laid off, leading to record youth unemployment.

The property sector has also been bludgeoned, hitting some of the country’s biggest home developers. The collapse in real estate — which accounts for as much as 30% of GDP — has triggered widespread and rare dissent among the middle class.

Thousands of angry homebuyers refused to pay their mortgages on stalled projects, fueling fears of systemic financial risks and forcing authorities to pressure banks and developers to defuse the unrest. That wasn’t the only demonstration of discontent this year.

In July, Chinese authorities violently dispersed a peaceful protest by hundreds of depositors, who were demanding their life savings back from rural banks that had frozen millions of dollars worth of deposits. The banking scandal not only threatened the livelihoods of hundreds of thousands of customers but also highlighted the deteriorating financial health of China’s smaller banks.

“Many middle-class people are disappointed in the recent economic performance and disillusioned with Xi’s rule,” said David Dollar, a senior fellow in the John L. Thornton China Center at the Brookings Institution.

According to analysts, the vulnerabilities in the financial system are a result of the country’s unfettered debt-fuelled expansion in the previous decade, and the model needs to change.

“China’s growth during Xi’s decade in power is attributable mainly to the general economic approach adopted by his predecessors, which focused on rapid expansion through investment, manufacturing, and trade,” said Neil Thomas, a senior analyst for China and Northeast Asia at Eurasia Group.

“But this model had reached a point of significantly diminishing returns and was increasing economic inequality, financial debt, and environmental damage,” he said.

A new model is needed

While Xi is trying to change that model, he is not going about it the right way, experts said, and is risking the future of China’s businesses with tighter state controls.

The 69-year old leader launched his crackdown to rein in the “disorderly” private businesses that were growing too powerful. He also wants to redistribute wealth in the society, under his “common prosperity” goal.

Xi hopes for a “new normal,” where consumption and services become more important drivers of expansion than investments and exports.

But, so far, these measures have pushed the Chinese economy into one of its worst economic crises in four decades.

The International Monetary Fund recently cut its forecast for China’s growth to 3.2% this year, representing a sharp slowdown from 8.1% in 2021. That would be the country’s second lowest growth rate in 46 years, better only than 2020 when the initial coronavirus outbreak pummeled the economy.

Under Xi, China has not only become more insular, but has also seen the fraying of US-China relations. His refusal to condemn Moscow’s invasion of Ukraine, and China’s recent aggression towards Taiwan, could alienate the country even further from Washington and its allies.

What are Xi’s options?

Analysts say the current problems don’t yet pose a major threat to Xi’s rule. He is expected to secure an unprecedented third term in power at the Communist Party Congress that begins on Sunday. Priorities presented at the congress will also set China’s trajectory for the next five years or even longer.

“It would likely take an economic catastrophe on the scale of the Great Depression to create levels of social discontent and popular protest that might pose a threat to Communist Party rule,” said Thomas from Eurasia Group.

“Moreover, growth is not the only source of legitimacy and support for the Communist Party, and Xi has increasingly burnished the Communist Party’s nationalist credentials to appeal to patriotism as well as pocketbooks,” he added.

But to get China back to high growth and innovation, Xi may have to bring back market-oriented reforms.

“If he was smart, he would liberalize things quickly in his third term,” said Guthrie.