Bitcoin has bounced this week, climbing back toward $20,000 per bitcoin—helped by a surprise bitcoin price prediction from a top U.S. regulator.

The bitcoin price has failed to regain its 2021 momentum, however, with the price of ethereum and other major cryptocurrencies struggling in the face of harsh Federal Reserve interest rate hikes designed to drive down soaring inflation that surged to a 40-year high this summer.

Now, as economic indicators flash signs the Fed’s monetary tightening measures could finally be having an effect, the author of the best-selling investment book Rich Dad Poor Dad, Robert Kiyosaki, has predicted the U.S. dollar could crash before January 2023—potentially pushing the price of bitcoin, ethereum and other cryptocurrencies higher.

«I believe [the] U.S. dollar will crash by January 2023 after [the] Fed pivots,» Kiyosaki posted to Twitter, adding: If the «Fed continues raising interest rates, the U.S. dollar will get stronger, causing gold, silver and bitcoin prices to go lower … when the Fed pivots and drops interest rates … you will smile while others cry.»

On Monday, the U.S. Institute of Supply Management (ISM) manufacturing purchasing managers’ index (PMI) dropped to 50.9 in September, the lowest reading since May 2020.

«These indicators are pointing to less inflation pressure, hence resulting in positive sentiment in global markets yesterday, including bitcoin,» Marcus Sotiriou, an analyst at digital asset broker GlobalBlock, wrote in emailed comments.

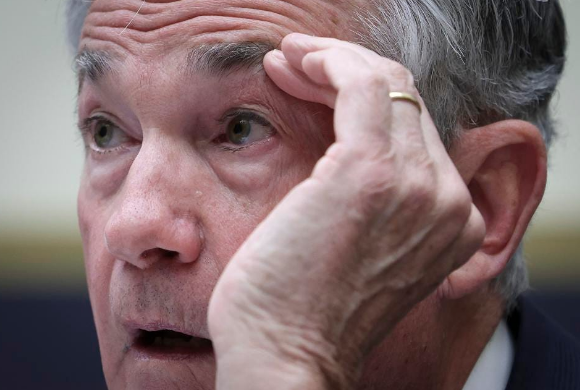

If inflation does begin to decline, traders are betting Fed chair Jerome Powell will put interest rate rises on pause.

«It’s been a case of ‘bad news is good news’ for equities, with the market treating the downside surprise to the ISM index as increasing the chances of an earlier Fed pause, seen as positive for risk assets,» the Bank of New Zealand analysts wrote in a note to clients seen by Coindesk this week.

Meanwhile, other market watchers are predicting the spring of 2023 could be when the crypto market «rebounds» following its $2 trillion crash this year.

«Interest rate hikes and the amount of available dollars in the market could be crucial to the future of BTCBTC 0.0%, ETHETH 0.0% and other cryptocurrencies,» Daniel Kostecki, a senior market analyst at the investment company Conotoxia.

«At present, the market is trying to catch its breath, just as expectations for the U.S. interest rate hikes may be catching their peak. It is estimated that in a quarter’s time, the U.S. dollar could be at an interest rate of 4.7%. If that were the peak, then perhaps the spring of 2023 could bring a bigger rebound in the cryptocurrency market as well, since expectations for interest rate cuts in the U.S. could begin to rise with falling inflation.»