On a rusty gas stove in Selena Ramirez’s apartment, a small flame was glowing.

Ramirez, 69, shares the apartment with her daughter and 11-year-old grandson. It is on the ground floor of a government housing complex in San Francisco de Yare, a city in Venezuela about 40 miles south of Caracas. The building’s outer walls are stenciled with the watchful eyes of the late Venezuelan president Hugo Chávez.

Ramirez keeps her stove’s back burner lit for hours when she does her household chores.

“I leave it on because matches are very expensive,” Ramirez said. “We can’t go buying them all the time.”

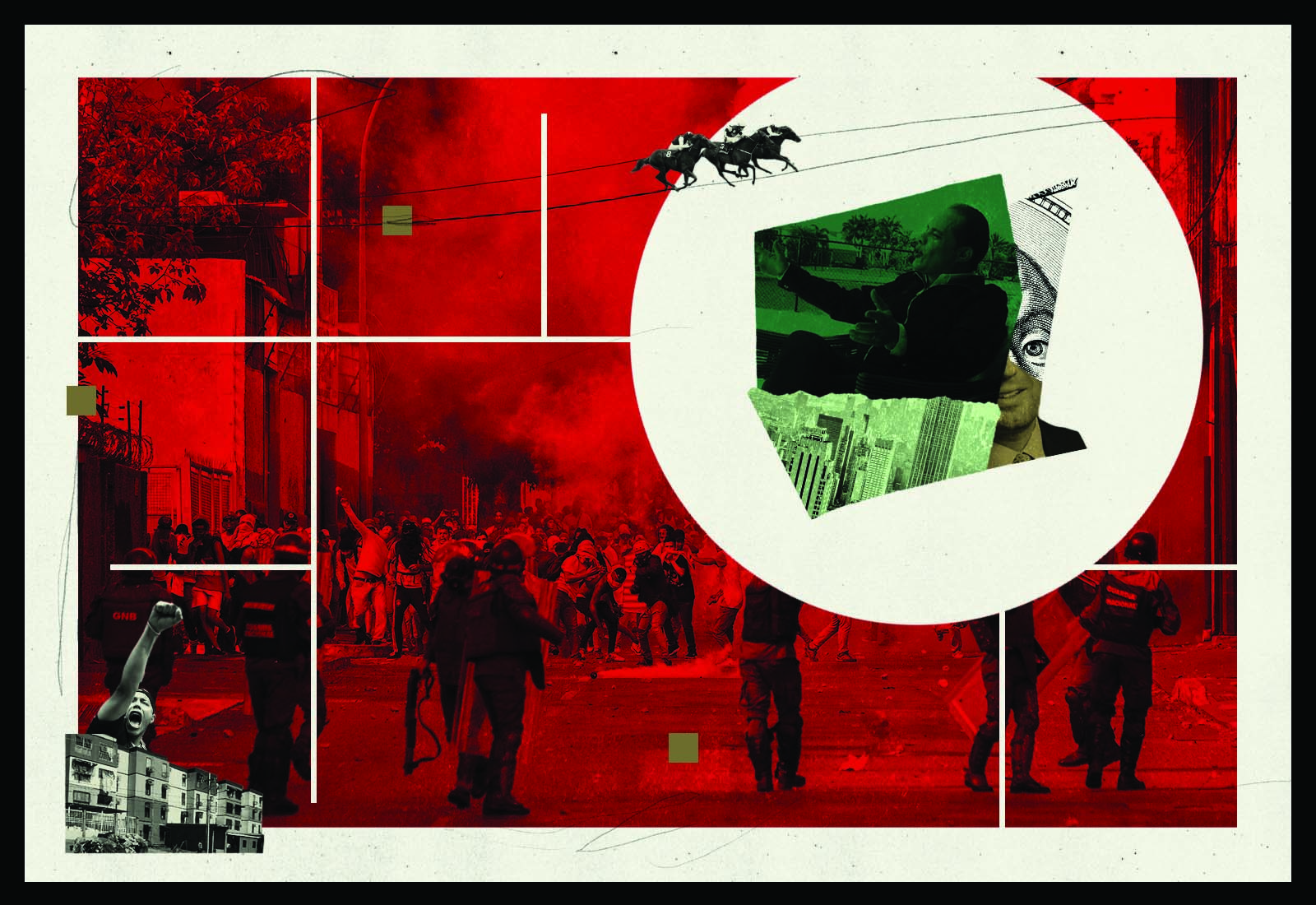

Venezuela is suffering one of the world’s gravest humanitarian crises. Inflation is out of control and the country’s oil industry, which once fueled the economy, is in shambles. One in three Venezuelans is not getting enough to eat, and about 5 million Venezuelans, more than one in six, have fled the country.

Wealthy businessmen with close ties to the governments of Chávez and his successor, Nicolás Maduro, have fueled the disaster. These tycoons are known as “boligarchs,” an ironic reference to South American independence hero Simon Bolívar, who Chávez invoked as the inspiration for his political movement. Their wealth derives in large part from government contracts, often to provide services for the poor.

A cache of secret bank reports, obtained by BuzzFeed News and shared with the International Consortium of Investigative Journalists, shows how boligarchs moved vast sums of dollars in public money out of Venezuela, including money intended for housing and other basic services, even as the country’s economy was collapsing. The cache, known as the FinCEN Files, includes more than 2,100 suspicious activity reports filed by banks to a U.S. Treasury Department agency known as the Financial Crimes Enforcement Network.

Alejandro Ceballos Jiménez, a construction mogul with cozy government connections, secretly routed at least $116 million from public housing contracts to recipients including offshore companies and bank accounts belonging to family members, the documents show. The contracts were for the construction of Ramirez’s housing complex, part of a grand plan to construct millions of affordable homes for ordinary Venezuelans.

Ceballos owns a mansion in the Venezuelan capital of Caracas and an eight-bedroom home in the suburbs of Miami, near a racetrack where his horses compete weekly for tens of thousands of dollars in prizes.

Ceballos is one of at least seven Venezuelan tycoons whose financial dealings with the Chávez and Maduro administrations are revealed in the FinCEN Files documents. These businessmen, known for their love of Rolexes and racehorses, mostly live outside Venezuela, favoring Florida, Madrid and the Dominican resort of Punta Cana.

The documents also reveal the pivotal role played by banks in Europe and the United States in facilitating the flow of money from Venezuela, despite blatant red flags signalling financial improprieties. Smaller lenders, which include the Swiss banks CBH Compagnie Bancaire Helvétique and the Julius Baer Group helped wealthy Venezuelans spirit cash out of the country, setting up offshore accounts that hid the origins of their money, the records and other documents show.

Banco Espirito Santo, headquartered in Portugal before it was broken up by regulators, moved more than a hundred million dollars out of Venezuela for the Ceballos family before U.S. and Portuguese authorities began investigating it for laundering money. Venezuela’s national oil company and an anti-poverty program called the Misión Che Guevara were among the state agencies that paid Ceballos companies huge sums, routed through a shell company in London.

Major global banks also played a part. JPMorgan Chase, based in New York, and Standard Chartered, headquartered in London, processed questionable transactions while serving as correspondent banks, an intermediary role in which multinational banks plug smaller lenders into the global financial system.

Overall, banks reported more than $4.8 billion between 2009 and 2017 in suspicious transactions with links to Venezuela, an ICIJ analysis found. Nearly 70% of that amount involved public money and had a Venezuelan government entity, such as the Ministry of Finance or the state oil company, as a party.

“That is what people don’t connect,” said Zair Mundaray, who served as a top anti-corruption prosecutor in Venezuela until he was exiled in 2017, and now advises opposition leader Juan Guaidó. “All the things that Venezuelans don’t have are from the money that went abroad.”

‘Los enchufados’

In a gated community outside Miami, Ceballos’ home dominates the corner of Jockey Circle and Steeplechase Drive. Horses nibble on lush green lawns of homes across the street.

About a half-hour drive from the property is the Gulfstream Park racetrack in Hallandale Beach, Florida. The racetrack is where horses from Ceballos’ racing stable compete each week for purses of up to $75,000. At its entrance a 110-foot tall Pegasus stands astride a vanquished dragon, the second tallest statue in the continental United States behind the Statue of Liberty.

For Ceballos, the thrill of winning a horse race is one of life’s great pleasures. “It is like giving a kiss to a beautiful woman,” he said in a 2016 interview published on his personal website.

Ceballos’ fortune comes from his family construction business, which has been operating in Venezuela for decades. The business was founded in 1978 by his mother, Maura Betty Jiménez de Ceballos, and many of its operations were consolidated in 2000 under its current flagship company, Inversiones Alfamaq. Grupo 7C, the parent company of the family’s businesses, takes its name from Maura and her six children — seven members of the Ceballos family.

“There isn’t a state in Venezuela that over these 37 years Alfamaq hasn’t worked in,” Alejandro Ceballos boasted in a 2016 interview.

Ceballos has been dogged by allegations of corruption. He was investigated by Venezuela’s opposition-controlled National Assembly for alleged participation in several schemes to steal public resources. In one instance, he was suspected of helping to divert $500 million from a state-owned aluminum and gold producer; in another, he allegedly collaborated in the improper sale of public lands in a tourism zone called “Acapulco Venezuela.”

The investigations, which Ceballos denounced on a company website as “unfounded accusations” promoted by “unwholesome interests,” were eventually dropped.

The Ceballos family maintained its close ties to the Venezuelan ruling elite during Maduro’s rule.

In 2016, Venezuela signed an agreement with Gold Reserve, a Canadian gold mining company. After an official ceremony attended by Maduro, a celebration was held at the Ceballos’ four-story mansion in the posh neighborhood of Alto Hatillo in Caracas, a former employee of the Ceballos family told ICIJ’s partners at Armando.info, a Venezuelan investigative news website.

Inversiones Alfamaq acquired a stake in Gold Reserve and provided “support services” to a precious metal mining operation in the southeastern state of Bolivar.

Among Venezuelans, government-allied moguls like Ceballos are also known as enchufados, or “plugged in.” Many consider them to be profiteers, exploiting a country that Transparency International ranked this year as one of the five most corrupt in the world.

Antonio Travieso, 55, a food vendor in the Chacao market in Caracas, said business ventures by the enchufados don’t offer any benefits to Venezuela or its people.

“It’s business that will bring easy money, money from cheating, with no concern about the consequences,” he told Armando.info.

Ceballos did not respond to ICIJ’s requests for an interview or answer detailed questions submitted in writing in August. In an email to an ICIJ reporter, he cited difficulties accessing documents due to Venezuela’s COVID-19 quarantine. He didn’t respond to later emails offering to extend the deadline for a response.

“In light of the following I confirm the impossibility of meeting your requests in the time specified, and I confirm the consideration that is due to journalists for their courage, valiance and ethics, provided that their work has respect for the truth as its true north,” Ceballos wrote.

‘Looting the wealth of a nation’

Much of the money that left Venezuela has vanished from public sight. FinCEN Files documents offer a rare view into where some of it went, and the banks that helped send it on its path.

The insight comes from the banks themselves.

A bank is required to send a suspicious activity report to FinCEN if it “knows, suspects, or has reason to suspect” that a transaction moving through the U.S. involves criminal money or has no apparent business purpose. These reports do not constitute criminal accusations, but they provide the financial system’s strongest line of defense against corrupt politicians, drug kingpins and ordinary criminals laundering ill-gotten gains. Lenders are supposed to actively seek out and report transactions that raise red flags for potential financial crime.

Instead, the FinCEN Files documents show banks often filed reports only in response to bad press about clients — and sometimes, as they faced inquiries into their own actions.

The Miami branch of Banco Espírito Santo, a Portuguese lender admonished by the U.S. government in 2005 for opening secret accounts for Chilean dictator Augusto Pinochet, processed more than $262 million in transactions linked to Ceballos.

Then, belatedly, it tried to verify the legitimacy of the Ceballos transfers, but could not. Payments to family members appeared “excessive,” documents intended to corroborate transfers “raised numerous concerns” and several transactions with entities tied to money laundering schemes appeared “artificial in nature,” according to reports the bank sent to U.S. regulators in 2013 and 2014.

Later in 2014, the Wall Street Journal reported that U.S. authorities were investigating Espirito Santo’s Miami branch for suspected money laundering linked to Venezuela.

After Espirito Santo was broken up by Portuguese authorities, the Miami branch was rebranded as Brickell Bank, then acquired in 2019 by Banesco USA. Banesco USA said the unit currently has no directors or management held over from previous owners and that it has a robust program in place to combat money laundering.

Banks contacted for this story cited client privacy and the confidential nature of suspicious activity reports in explaining why they couldn’t address detailed questions about transactions.

CBH denied any involvement in laundering money linked to Venezuela. The Julius Baer Group said it regretted its past shortcomings and that it had recently taken sweeping measures to strengthen its controls against money laundering.

Banks that have been tied to suspicious dealings related to Venezuela have faced varying responses from regulators.

Some, like CBH, have faced little scrutiny. The Swiss government banned Julius Baer from “large and complex acquisitions” and appointed an independent auditor to monitor its activities. Espirito Santo was shut down by regulators in connection with money laundering investigations.

But the punishments came only after they had already helped move billions of dollars out of Venezuela. Overseers of the global financial system proved helpless to contain the torrent of money that flowed from Venezuelan public coffers to private bank accounts from Geneva to Miami, ICIJ found.

“Bankers were completely embedded in this scheme of looting the wealth of a nation,” said Martin Rodil, founder and CEO of InterAmerican Solutions, a consultancy that advises the U.S. Treasury Department on Venezuela sanctions. “Without the banks, this would not have happened.”

The Gran Misión Vivienda, a plan to build two million homes for the poor and working class, was one of President Chávez’s most ambitious undertakings.

“The housing problem cannot be solved from within the capitalist system,” Chávez thundered during the program’s nationally broadcast inauguration ceremony in April 2011. “Here we are going to solve it with socialism and more socialism.”

The following year, Venezuela awarded a $126 million contract to an Italian energy company, Energy Coal SPA, to build 1,540 low-income apartments for the project in San Francisco de Yare. The town was a political stronghold of Chávez, known for an annual religious festival called the Dancing Devils of Yare in which worshippers disguised as demons dance through the streets.

The deal called for the Venezuelan government to trade the Italian company coke, a coal-related fuel, in exchange for building the homes. The Italians, however, “did not have either the technical capacity or the experience” to build the homes, a Venezuelan government investigation later found. Energy Coal subcontracted the job to Sarleaf Limited, a London-based company controlled by Ceballos and his relatives.

Swiss lawyers served as frontmen for Sarleaf to conceal the Ceballos family’s ownership, according to a report that Espírito Santo later filed with the U.S. Treasury Department. The offshore company was created for “security purposes” to “protect the Ceballos family from being exposed in Venezuela,” the bank wrote.

Between April 2013 and January 2014, Venezuelan government agencies paid Sarleaf more than $146 million, Espírito Santo reports say. Among the agencies that worked with Sarleaf were the state oil company and an anti-poverty program called the Misión Che Guevara.

Sarleaf then distributed tens of millions of dollars to companies and bank accounts belonging to members of the Ceballos family, Espírito Santo reported.

Ceballos’ son, Alejandro Andres Ceballos, appears to have been the biggest beneficiary. He collected $22 million through a bank account set up to manage his “savings, investments, and personal expenses,” and another $22 million through a company in Panama that “provides import export facilitation services of products in the construction industry.” Alejandro Andres Ceballos did not respond to questions that ICIJ sent to his company Proyectos y Construcciones 1128 and to Inversiones Alfamaq.

Espirito Santo found that some transfers were “in line with the purpose of the accounts” used for the family’s construction businesses (for example, $24 million was sent to Inversiones Alfamaq). But the bank raised concerns about more than $6 million that the businesses sent to family members’ personal accounts, just days after receiving the money from the Venezuelan government via Sarleaf.

“The pattern of payments and the significant portion or margin sent to the family members appears to be excessive,” wrote Espírito Santo in a February 2014 report.

After reviewing invoices and contracts provided by Sarleaf to corroborate another batch of transfers, Espírito Santo concluded they were probably “artificial in nature” — meaning fake transactions connected to money laundering or tax avoidance.

In 2015, the Venezuelan government investigated the housing project. Its probe found “irregularities” in its financing and concluded that Sarleaf had overcharged for its work.

Residents began moving into the complex in late 2015, tenants told ICIJ’s partners at Armando.info.

Selena Ramirez’s apartment is complete but sparsely furnished, with a handful of chairs, a table, a refrigerator and a sewing machine. Tap water is available only a few hours each day. By the entrance, a small sign invites passersby to sign up for sewing lessons.

“I’m a seamstress, I know how to make shoes,” Ramirez said with a smile.

Many of her neighbors are fleeing Venezuela and its ruined economy. They leave behind empty apartments that look as if they have been ransacked, Ramirez said.

The Ceballos family had tapped into a rich vein of income from the Venezuelan government. But to enjoy that money far from the crisis gripping Venezuela, and acquire assets like property and racehorses in South Florida, the family needed help.

The family had to be able to move dollars, which were in scarce supply in Venezuela due to runaway inflation and strict controls on foreign currency.

Espirito Santo Bank, then Portugal’s second-largest lender, and its branch in Miami, stood ready to assist. Ricardo Espirito Santo Salgado, the bank’s longtime chief executive, had cultivated close relationships with government officials and wealthy families in developing countries as part of an aggressive growth strategy.

In 2012, Espirito Santo set up a business checking account for Sarleaf, the offshore company secretly controlled by the Ceballos family.

The bank processed more than $262 million in payments linked to Sarleaf, as well as transactions associated with tycoons Isabel dos Santos of Angola and Dmytro Firtash of Ukraine, FinCEN Files documents show. Dos Santos and Firtash face criminal charges of corruption in Angola and the U.S., respectively. Other banks involved in those transactions reported them to FinCEN as possibly linked to corruption.

In 2014, Espirito Santo came crashing down. Portuguese authorities shut the troubled lender and moved its healthy assets into a new bank, Novo Banco, that was controlled by Portugal’s central bank.

Salgado was arrested and briefly detained. In July of this year, prosecutors charged him with money laundering, bribery, embezzlement and tax fraud.

The Swiss bank CBH has also been repeatedly linked to Venezuelans accused of corruption.

Among its most prominent clients was Alejandro Betancourt, who was only 29 when he founded Derwick Associates, an energy firm that snagged billions of dollars in no-bid contracts to fix Venezuela’s failing power grid. Betancourt and his well-connected young partners became known as the “bolichicos” — the little boligarchs.

In 2018, the U.S. Justice Department charged a senior Derwick executive, Francisco Convit Guruceaga, and seven others in an alleged $1.2 billion bribery and money-laundering scheme. Betancourt was cited in the criminal complaint as an unnamed co-conspirator, the Miami Herald later reported.

Despite Betancourt’s efforts to shut down the case — which included hiring President Donald Trump’s personal lawyer, Rudolph Giuliani, to lobby the Justice Department on his behalf — prosecutors kept digging. In February, Switzerland’s highest court ordered CBH and other Swiss banks to release Betancourt’s records to U.S. prosecutors.

A 2019 Bloomberg News investigation found that CBH served Venezuelan clients on both sides of money transfers and allowed them to use the bank’s Geneva headquarters as their address of record — special privileges that helped them avoid regulatory scrutiny.

Another Swiss bank used by top executives at Derwick was the Julius Baer Group.

Betancourt and Convit were personal clients of Julius Baer’s former managing director and vice chairman Matthias Krull. In October 2018, Krull was sentenced to 10 years in prison for his role in the $1.2 billion money laundering scheme.

CBH denied involvement in corruption linked to Venezuela, and disputed Bloomberg’s reporting. The bank fully divested from Venezuela in 2013, CBH’s Head of Legal Christopher Robinson told ICIJ’s partners at the Miami Herald.

“CBH does not and has never engaged in, facilitated, or condoned money laundering, corruption, embezzlement, or any other unlawful acts or unlawful banking transactions,” Robinson said.

The Julius Baer Group said that Krull committed his crimes outside the scope of his official duties for the bank, and that it had exited the Venezuelan market in 2018. The bank said it has taken “comprehensive measures” to improve its oversight during the last three years.

“We regret the shortcomings identified in our business with Latin American clients,” the Julius Baer Group told ICIJ in a statement.

An attorney for Betancourt said his client denied any wrongdoing, and Convit’s attorney declined to comment.

The Wall Street connection

Illicit cash doesn’t just slosh through Swiss banks and offshore financial centers. Much of it winds up flowing through two financial capitals: New York and London.

Wall Street, in particular, plays a vital role. The Federal Reserve grants the biggest banks a special power — transforming different currencies into dollars, the world’s reserve currency, and sending them along to other banks or companies. This little-noticed service, offered for a fee to smaller and regional banks, keeps the gears of global finance moving.

FinCEN Files documents show these financial institutions, known as correspondent banks, alerting U.S. authorities to dozens of suspicious payments involving Derwick, CBH and Julius Baer.

To ensure they aren’t moving illicit cash, big banks are supposed to scrutinize their clients — the smaller banks — and the millions of payments that flow through their accounts. Suspicious activity reports show that this vetting is both haphazard and ineffective, with the correspondent banks often unable to conclusively determine whether money they handle comes from criminality or corruption. They often flag transactions years after they happened.

Correspondent banks played a crucial role in allowing the proceeds of suspected corruption in Venezuela to flow from Caracas to Zurich to New York and then be spent around the world.

For example, Derwick sent nearly $12 million to a company called Mediterraneo Global Investments. Standard Chartered, acting as the correspondent bank, later determined that the payments were suspicious, but it could not ascertain the “business profile and identity” of the company.

Closer scrutiny of its own records could have offered valuable insight. The same bank, Standard Chartered, had flagged Mediterraneo just a month before as having received $6.5 million from a company linked to Martin Lustgarten Acherman. The Venezuelan businessman was charged by U.S. authorities in May 2015 with laundering millions of dollars for drug cartels using Venezuelan black market currency schemes.

Lustgarten has denied the charges, which were later dropped after his lawyers filed court documents claiming that prosecutors had failed to obtain key banking records from other countries.

Three of the companies in Lustgarten’s network used bank accounts at CBH, Standard Chartered found.

A February 2017 report by JPMorgan Chase, also acting a correspondent bank, flagged transfers made by Julius Baer. The report examined suspicious companies and payments linked to Alejandro Isturiz, an official at the procurement arm of Venezuela’s state oil company. Isturiz was indicted later that year in Texas on federal money laundering charges.

One of the subjects of the report was a Panamanian company linked to Isturiz, Large Investment Inc., that used a Julius Baer account in Switzerland and paid or received money from three other entities. Isturiz is a fugitive from U.S. justice and, as of 2018, remained at large. ICIJ was unable to reach Isturiz for comment.

In a statement to ICIJ, JPMorgan Chase acknowledged that earlier in the decade its anti-money laundering regime “needed improvement,” but that it has now taken a leadership role in the fight against financial crime. Standard Chartered said it has made major investments in its compliance program and undergone a “comprehensive and positive transformation over the last several years.”

Mundaray, the former Venezuelan prosecutor, said money flowing from public corruption in Venezuela has successfully been laundered on a massive scale. “What started with the small complicit banks ended up inundating the banking system,” Mundaray said.

Still winning

President Trump’s administration has taken a hard line on Venezuela. In March, the U.S. charged Maduro with drug trafficking and corruption. The U.S. has also sanctioned more than 90 officials in Maduro’s government and state institutions, including the Central Bank of Venezuela and the state oil company.

But most of the Venezuelan government’s business partners have avoided repercussions, despite glaring red flags in their financial activities.

Out of at least 26 people, companies and government entities with suspicious transactions related to public funds cited in the FinCEN Files, three have been sanctioned by the Office of Foreign Assets Control. A large conglomerate has also been investigated and has faced criminal charges in Latin America.

The impunity enjoyed by many of the boligarchs is a direct consequence of banks’ failure to apply proper scrutiny to their clients’ financial activities, Mundaray said. “None of the banks investigated this sufficiently,” he said. “Because what happened was really the sacking of a country.”

In addition to longstanding destinations of choice such as Miami and Switzerland, business elites close to the Maduro regime have recently embraced new havens for their wealth, moving money to destinations including Hong Kong, Cyprus and Turkey.

In Venezuela, the Ceballos family continues to win government contracts. Recent jobs have included repairs to water treatment facilities in the northern state of Anzoategui and pumping stations in three Venezuelan states — both of which are now underway.

It is unclear how often Alejandro Ceballos stays at his home outside Miami, but his Grupo 7C Racing Stable has flourished, with its horses winning at least 116 races since its founding.

In 2016, Ceballos’s horse Majesto competed in the Kentucky Derby, a moment Ceballos said he had dreamed of since he was six years old. In an interview before the race, Ceballos expressed confidence that Venezuelans would be rooting for a Majesto victory.

“I want to say to Venezuela to feel that this horse is yours,” Ceballos said. “It is the effort of all Venezuelans.”

Majesto finished near the end of the pack.

Fuente: Icij