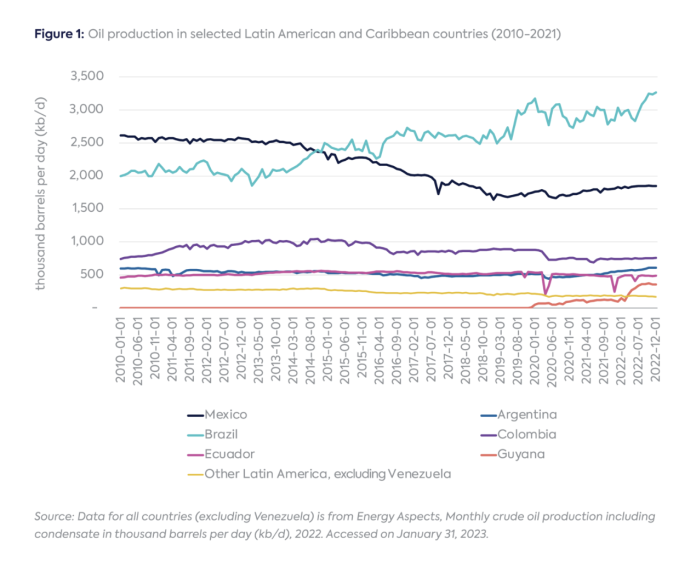

Latin America’s oil sector has experienced tectonic—and likely irreversible—changes during the past decade. Production fell to 7.8 million barrels of oil per day (mb/d) in 2022 from 10.4 mb/d in 2010, with the global market share dropping from 12 percent to 9 percent.[1] Oil is making a retreat from Latin America’s traditional producers, including Mexico and Venezuela. Given current nationalistic policies and excessive reliance on overindebted national oil companies (NOCs), the trend is unlikely to reverse in those countries. But not all oil-producing countries in the region are on this trajectory (Figure 1). Brazil, now the world’s eighth-largest oil producer, and Guyana, one of the world’s poorest countries, are surpassing the traditional producers to become undisputed oil-producing leaders in the region.

Together, Brazil and Guyana will produce more than 5 mb/d of oil by the second half of this decade. Their success underscores the importance of stable regulatory frameworks and the corresponding access to global capital and technology from international oil companies (IOCs). In contrast, declining production in the region is mostly associated with policy instability. This post looks at the region’s leaders and laggards, arguing that declines in production, despite significant reserves, can be explained by institutional factors and policy choices with long-lasting consequences.[2] Even if policies change now—unlikely by all indications—current trends will be hard to reverse in a future with lower expected global demand for oil and less capital allocated to fossil fuels.

Brazil: From net importer to top oil producer

Brazil, a net oil importer until 2014, surpassed Venezuela as the top oil producer in Latin America in 2016. This shift is mostly due to high productivity from the offshore pre-salt cluster, which has grown quickly from around 602 thousand barrels per day (kb/d) in 2014 to around 2.3 mb/d in 2022, allowing oil exports to reach 1.1 mb/d last year.[3] According to the International Energy Agency (IEA), significant investment in recent years, despite delays and cost overruns, will allow Brazil to produce 4.4 mb/d in 2030. Adding oil to a basket of commodities where Brazil is already a relevant player will further increase its geopolitical weight.[4] Expansion of refining capacity has made Brazil less dependent on imports of distilled products, indicating that the sector’s development has gone hand in hand with a reindustrialization strategy. For now, oil will strengthen Brazil’s regional leadership (Figure 2).

Guyana: One of the world’s fastest-growing economies fueled by its increasing oil output

Commercial oil production in Guyana started in 2019 (Figure 2) after major offshore fields were discovered in 2015. A consortium led by ExxonMobil—using two floating production, storage, and offloading (FPSO) vessels—has increased production from 14 kb/d in 2019 to 270 kb/d in 2022.[5] A third FPSO unit is expected to begin operations in 2023, increasing producing capacity to 500 kb/d, and a fourth one by 2025 will add 250 kb/d of capacity.[6] Guyana’s Finance Ministry expects production to surpass 800 kb/d by 2025, more than Argentina, Ecuador, Colombia, and Venezuela.[7] The IEA projects Guyana’s production will reach 1.4 mb/d by 2030.[8] Finally, the government of Guyana launched its first licensing round for offshore oil and gas exploration and production in December 2022. The question now is not whether Guyana will produce more than a million barrels per day but whether it will avoid the pitfalls of many other countries with significant natural resource discoveries. These include weak governance, corruption, and low competitiveness of domestic production. Geopolitically, Brazil could potentially forge a regional alliance with Guyana, covering broader issues such as biodiversity protection.

Mexico and Venezuela: Once dominant, now experiencing declining production

Mexico and Venezuela are losing ground (Figure 3). Mexico, once the top crude oil producer and exporter in Latin America, reached peak oil production in 2004 at 3.2 mb/d.[9] Since then, its largest oil assets have faced natural declines and production fell to 1.8 mb/d in 2022.[10] In 2013, a constitutional reform allowed new players in oil exploration and production activities to compete with NOC Pemex via auctions, which resulted in over 100 contracts awarded to more than 70 companies.[11] Since 2019, President Andrés Manuel López Obrador has canceled new oil auctions while pumping tax funds into Pemex, the most indebted oil company in the world.[12] Non-Pemex oil production reached 98 kb/d in 2022 (about 6 percent of the country’s total). Mexico’s oil production is expected to remain stagnant, with private companies offsetting Pemex’s decline. This, paired with around 790 kb/d of imported oil products, means that Mexico transitioned from net oil exporter to net importer.[13] These trends are likely to continue unless there are substantive changes leading to a ramp-up of the oil and gas industry or a steep reduction in demand for gasoline and diesel in the transportation sector.

Much of the decline in Latin America’s global share of the oil market can be explained by the collapse of oil production in Venezuela to 0.7 mb/d in 2022 from 2.8 mb/d in 2010, following years of political unrest, poor management of its NOC PDVSA, and international sanctions.[14] On November 22, 2022, the US Treasury Department granted Chevron a license to restart operations in Venezuela. The IEA expects this could add 100 kb/d in oil production by the end of 2023, but with current policies a significant increase in production is out of sight.[15] Even if sanctions are lifted with a return to democracy, investors might favor geographies with lower lifting costs and higher-grade oil, such as Brazil and Guyana.

Argentina, Colombia, and Ecuador: Resource and policy uncertainty

Argentina, Colombia, and Ecuador face stagnant or declining outputs (Figure 4). Argentina has seen robust production since at least the second half of 2020, mostly of tight oil in the Vaca Muerta formation (which is offsetting the decline in conventional oil production). The IEA expects overall production to be above 700 kb/d in 2023, higher than at any point in the past decade.[16] However, prospects after 2030 are less optimistic, as conventional production is expected to continue falling. Moreover, Argentina is not a major actor in global oil markets, with export volumes averaging between 100 and 200 kb/d.

Crude production in Colombia peaked in 2014 at 1,040 kb/d. The maturing of Colombia’s traditional assets led to a rapid decline in production to 760 kb/d in 2020. Oil production will experience long-term decline despite promising new offshore discoveries, as these will take a long time to develop, if at all, in the current environment of policy uncertainty. President Gustavo Petro has stated that his administration will not grant new oil, natural gas, or coal contracts in order to reduce Colombia’s economic dependence on oil.[17] In the current policy environment, the only question is the speed at which oil production will decline.

Crude production in Ecuador, a longtime member of the Organization of the Petroleum Exporting Countries (OPEC), peaked in 2014 at 560 kb/d. Ecuador’s production, located in the Amazonian region, frequently faces opposition from local indigenous communities and environmental groups. In 2020, production was disrupted by the COVID-19 pandemic and a landslide that damaged two key oil pipelines, falling by 6 percent to 511 kb/d. Production has still not recovered to pre-pandemic levels and President Guillermo Lasso’s goal of raising it to 1,000 kb/d by 2025 is unrealistic given lack of investment in midstream and low investor appetite. The IEA expects Ecuador’s production to further fall to 450 kb/d in 2023.[18]

Countries with maturing fields, such as Argentina and Colombia, can potentially reverse the declining trend with offshore or unconventional developments that are highly capital-intensive, difficult to finance, and require a stable policy environment that may remain elusive, especially for Colombia.[19]

To conclude, this new oil landscape in Latin America is likely to remain unchanged as declining global oil demand—projected to be between 40–70 percent lower in 2050 than today—will restrict access to capital.[20] For traditional oil producers, it will be critical to find new sources of fiscal and external revenues in order to avoid economic and social decay.»