First quarter earnings season will ramp up this week with several big banks reporting results on Friday.

And when this earnings period largely wraps up by Memorial Day, analysts expect one clear takeaway to emerge — corporate America is in an earnings recession.

After earnings per share for S&P 500 companies fell 4.6% in the fourth quarter of 2022, earnings are expected to drop 6.8% from the prior year in the first quarter of 2023, according to data from FactSet.

«Analysts and companies have been more pessimistic in their earnings outlooks for the first quarter compared to historical averages,» wrote FactSet’s John Butters in a note.

«As a result, estimated earnings for the S&P 500 for the first quarter are lower today compared to expectations at the start of the quarter. The index is now expected to report its largest year-over-year decline in earnings since Q2 2020.»

With two-straight quarters of year-over-year earnings declines, this pushes profits for the market’s biggest companies into a recession.

By definition, investor debate about what is «priced in» to the market can never be settled. This is what the market is for, after all.

Whether this earnings recession is confirming the obvious or serves as new information is a question we’ll leave investors to sort out. But the market’s behavior last year that saw the S&P 500 endure its steepest drop since 2008 suggested investors were bracing for corporate results like those feeding through now and what may be coming in the quarters ahead.

During the first quarter, analysts cut expected per-share earnings growth by 6.2%; over the last decade, the average intra-quarter decline in earnings expectations is 3.3%.

And the news isn’t expected to get much better in the second quarter, with FactSet noting expectations for Q2 are that earnings for the S&P 500 will drop another 4.6% from the prior year. In the third quarter, earnings are expected to return to growth.

With recent data from the manufacturing sector, services sector, and the U.S. labor market suggesting a downturn in the economy is drawing nearer, this downturn in the corporate world doesn’t come as a total surprise.

After all, investors have been fretting over a seemingly imminent U.S. recession for most of the last year as surging inflation and aggressive rate hikes have set off indicators warning of a future downturn in growth.

But some strategists don’t think the market is done pricing in gloomier outlooks for profits. And expect that investors will eventually heed the warnings being sent by corporate bottom lines.

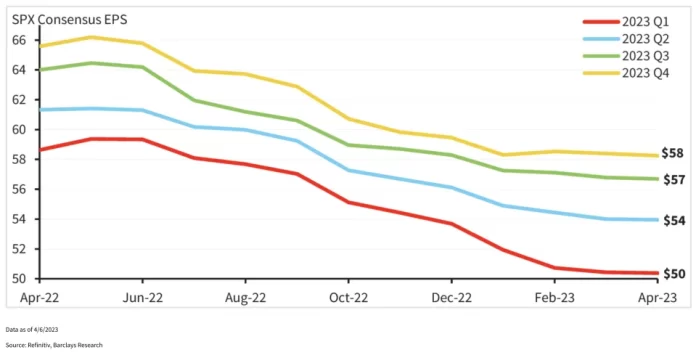

«Investors may be looking through an earnings contraction in 2023 to a strong recovery next year, essentially in a bid to pay peak multiples on trough earnings,» wrote Barclays strategist Venu Krishna in a note to clients on Monday.

«However, we are confident that [next twelve months] EPS cuts are far from done; consensus estimates look consistently too optimistic even a few months away, and a potential recession only increases the degree to which forward estimates overestimate actual earnings.»

As FactSet’s work flagged, earnings estimates for first quarter earnings have come down sharply while estimates for the full-year remain relatively firm.

Investors are still expecting the S&P 500 to earn $219 per share in 2023; Barclays expects full-year earnings to come in closer to $200 per share.

«Ultimately, we believe the market is still pricing in a ‘no landing’ scenario: one where the Fed brings inflation under control (perhaps at a level somewhat higher than its 2% target), while economic growth skirts a recession and eventually rebounds strongly in 2024,» the firm wrote.

«This is the outcome that best supports current consensus, and we just don’t see it. Our base case continues to be for a shallow recession to occur this year, and if the history of recessionary bear markets (particularly high-inflationary ones) is a guide, both sides of the P/E multiple remain exposed to asymmetric downside risks.»