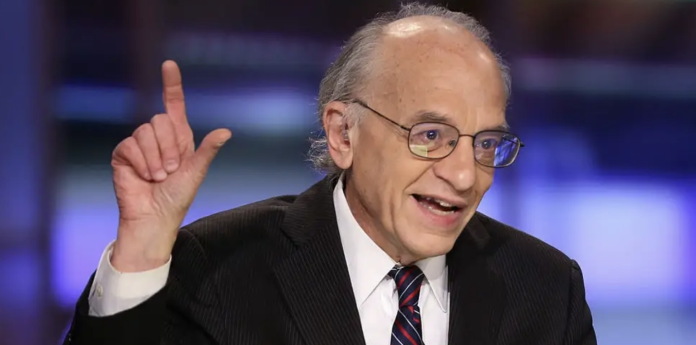

After the bloodbath for stocks this year, 2023 is looking brighter as the Federal Reserve could start cutting rates by mid-year, according to Wharton professor Jeremy Siegel.

«My feeling is that the stock market is anywhere from 10-15% undervalued on a long-term basis, and I think 2023 is actually going to be a very good year for equities,» the top economist said in an interview with the Wharton School on Tuesday.

That comes after a difficult year for the market, with the S&P 500 tanking 17% amid persistent inflation and the Fed’s aggressive rate hikes. But inflation is largely in the rear-view, Siegel said, who doubted central bankers would see the need to keep rates high much longer. Previously, he pointed to cooling inflation indicators, like falling home prices, to suggest inflation has already peaked, and is likely overstated in the official data. Headline inflation continued to cool further in November to 7.1%, the fourth-straight month of declines.

«If the Fed continues to hike next year or stays high, I think they are going to start bringing down the fed funds rate by mid-year. Now, some economists don’t think it’s going to happen until 2024, but I think that would remain tight way too long, and I think they’re going to see the evidence of a slowdown. Once they see that unemployment rate rise, jobless claims rise, and the real economy soften, they’re going to back away and start talking about a decrease,» he added.

Already, central bankers have raised rates 375-basis-points this year, with broad expectations for another 50-basis-point hike at this week’s Federal Open Markets Committee meeting. Siegel has been a loud critic of the Fed’s late response to rising inflation, which has upped the risk of overtightening the economy into a recession.

But a mild recession would be unlikely to send stocks to another low, he said, adding that the stock market typically bottoms four to five months before the economy. Previously, he predicted at least a 20% gain in stocks next year.

That’s contrary to the warnings of many Wall Street analysts, who have sounded alarms that the S&P 500 could crash and bottom early next year. Bank of America, Morgan Stanley, and Deutsche Bank have predicted around a 25% drop to the benchmark index as a recession slams the economy, spelling trouble for investors in the short-term.